Watch Trading First Year in Review & Progress 2020

Backstory:

My name is Mohi Ahmed, I’m 26-year-old working as a Risk Management Engineer for a medical device company and up until very recently, ran a small business selling lotion—I traded watches a couple hours a month during 2020 while working a 9 to 5 and running that lotion business. I started watch trading on Jan 20th, 2020 after sitting on the sidelines for 2 years watching the courses and reading the facebook group, but never taking action.

Like many of you, I got part 1 of the training and then sat on the sidelines making excuses for myself because I said any money that could be used for watches was better off going into my small business first and I’d eventually get around to trading. I came up with a bunch of reasons of why I “couldn’t” start. I was in school, I was busy with this other business etc. Eventually I realized this was a serious business opportunity and I decided to treat it like a business. So, I bought Part 2 and Knightwatch and went to a WTA conference in late 2019 and treated all of these as “start-up costs” to this new watch trading business. Over the years I have gotten so much ROI from PJ and Cal’s courses that I have bought almost everything they have ever offered for sale over the last 3 years.

Again, like many of you, I didn’t have any capital to start. But thanks to the advanced courses, I had the confidence to buy my first two watches on a credit card. I don’t recommend that for beginners unless you have the advanced courses. Instead, use paypal credit to get the advanced courses and then use your cash and the new knowledge to trade watches and pay the bill—two birds, one stone. If you can avoid it, just save up the 1500-2000 to get started using actual cash, but if you’ve taken the advanced courses and have the confidence that comes with them, you can start with paypal credit or a credit card.

So let’s see how I did:

Time Commitment: A couple hours a month

Capital: $0 to start, 5k credit limit

Courses: Part 1, Part 2, and Knightwatch, Mastermind & WTA conferences

GOAL: Reinvest all profits and only sell to retail clients (I’ll explain later why this was a flawed approach)

My 2020 Trades

Note: Markets change. Do not follow my numbers. Use the training you paid for to calculate your own target buys and sells for TODAY’S market.

1. Omega Planet Ocean 45mm 2200.50 on bracelet w/box

IN: 2151

OUT: 2350

PROFIT: 199

ROI: 9.5%

HOLD: 90 days

SOURCE: Chrono24 in, Ebay out

2. Breitling Superocean Heritage 46mm Blue on bracelet naked (added box and travel case)

IN: 1800

OUT: 2700

PROFIT: 900

ROI: 50%

HOLD: 19 days

SOURCE: Chrono24 in, Local out

3. Breitling Superocean Heritage II 42mm black on bracelet full set

IN: 2660

OUT: 3000

PROFIT: 340

ROI: 12.8%

HOLD: 70 days

SOURCE: WTA BST in, FB Marketplace out

4. Breitling Navitimer World GMT 46mm black on leather full set

IN: 3350

OUT: 3500

PROFIT: 150

ROI: 4.47%

HOLD: 38 days

SOURCE: WTA BST in, FB group out

5. Tudor Black Bay Bronze 1st gen on leather full set

IN: 2350

OUT: 2700

PROFIT: 320

ROI: 13.6%

HOLD: 91 days

SOURCE: WTA BST in, Ebay out

6. Breitling Superocean Heritage II 46mm blue on bracelet full set

IN: 2630

OUT: 3100

PROFIT: 470

ROI: 17.87%

HOLD: 55 days (listed for 14 days)

SOURCE: Ebay in, FB Marketplace out

7. Breitling Navitimer World GMT 46mm GMT black on leather full set

IN: 3350

OUT: 3800

PROFIT: 450

ROI: 13.4%

HOLD: 54 (listed for 14 days)

SOURCE: WTA BST in, FB Marketplace out

8. (Broker Deal) Navitimer World GMT 46mm Black on Bracelet Full set

IN: 3850

OUT: 4200

PROFIT: 350

ROI: 9.09%

HOLD: 2 days

SOURCE: WTA BST in, FB marketplace out

9. Panerai PAM 311 full set

IN: 8650

OUT: 10550 + 200 tip

PROFIT: 2100

ROI: 24%

HOLD: 62 (listed for 31 days)

SOURCE: WTA in, Chrono24 out

10. Omega Planet Ocean Goodplanet edition Full Set

IN: 3651

OUT: 4500 (net 4019)

PROFIT: 328

ROI: 8.98%

HOLD: 31 days

SOURCE: ebay in, sold on ebay

Average ROI: 16.41%

Average Profit: 561

Average Hold: 51.2 days

Total Profit: $5608

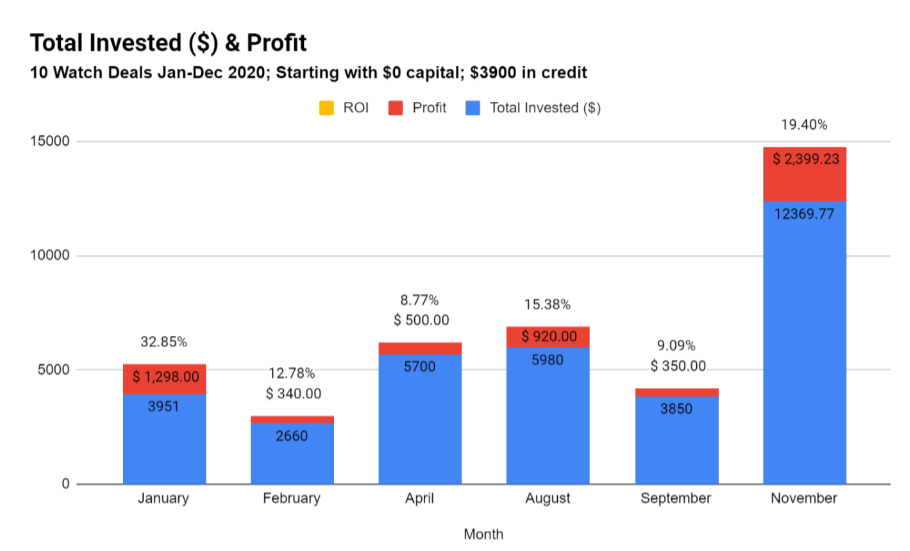

Key Takeaway from this Chart: Notice that this growth is EXPONENTIAL. By not starting, you are robbing your future self of a lot of money. When situations are exponential people don’t realize a 1 month delay today means a 3-month delay of where your income could have been 6 months from now, so you need to START ASAP. When you think in these terms, the 2 years I sat on the sidelines were the most expensive 2 years of my life due to opportunity cost.

Key Takeaway from this Chart: The recession (March to December) had no impact on how much money I could make trading. I made more money deep into the recession in November than I did in the months before the recession (January and February) simply because I had more money to invest. (Gaps between months are due to long holds waiting for things to sell so I could invest in something new).

Lessons Learned:

I was planning on moving to Florida in 2020 so I told myself I was going to step up to the challenge of learning how to sell to retail clients only even though I had never sold a watch before so that I could build up my network here in the Chicago suburbs before I moved away. In hindsight, the approach I now recommend, which is what PJ and Cal have been telling me to do from the beginning is this:

For your first 10 deals, take the first deal where you’re offered 10% ROI or better. If after 3-4 weeks the watch hasn’t sold, sell it for break-even or even a small loss and move on. Breaking even doesn’t sound exciting but in the beginning you’re learning the tiny details of the process that PJ can’t spell out for you in the course and you’re building a network. If you sell for breakeven or 10% ROI, you’re either giving a retail client an incredible deal to start a relationship (and you can make more money from them later) or you’re selling to a wholesaler who in the future you will need as a reference in the business and a source of wholesale deals and broker opportunities. My first year was plagued with long holds and while I did get the retail clients I was looking for, instead of waiting 3 months for a retail seller I could have liquidated or wholesaled sooner and moved on to several watches in that same period of time which would give me more “at bats” to reel in a retail client within the first 2 weeks and I would have made more money to reinvest. I waited 3 months to make an extra 300 dollars instead of buying and selling 3 more watches in that same time frame.

Keep in mind all of this was accomplished with little starting capital, no network, and during a recession! 5.5k profit might not blow you away, but if that’s what’s possible for someone in my position, imagine would YOU could do. The fact that this was accomplished during a recession should show you the power of watch trading.

Not too long ago, I only had part 1, and I was just like you. But the investment in my education gave me the confidence to start trading and I never come close to panic selling any of my watches during the recession. If you’re sitting on the sidelines or have questions about the value of the advanced courses, please talk to me!

I am not too far into the “game” than where you are right now, please learn from my experience!

If you’re looking for help, book a call with me to talk about what challenges you’re facing:

https://go.oncehub.com/1on1withAWatchTrader

Going Forward:

Since the beginning of 2021 I have already brokered a PAM 1537 for a previous client, bought a PAM 90 on ebay, and 2nd gen planet ocean from a wholesaler I sold to back in 2020, I have a couple broker deals in the pipeline and I still have money to spend on inventory.

This isn’t official advice but in 2021 I have more time to put into trading so I will be getting very aggressive on my goals. I am starting this year with about 15k in capital to play with and will be aiming to have at least 50k by the end of the year. To achieve this, I ran the numbers and found a sweet spot of five 5k deals a month on average with relatively conservative ROI to help me get there, but towards the end of the year a couple 10k deals will be an extra needed boost. That’s the general idea, but it’s not a rigid plan. I will be dumping all of my 15k capital into watches and then also leveraging paypal credit and a business credit card for even more deals. Whenever I am buying on credit I will be very strict about purchasing at target so that I know I can liquidate before the bill comes due. I will be heavily focused on dropping my hold times so expect some deals from me in the WTA buy/sell/trade group this year (talk to me about getting access if you don’t have this).

To celebrate my first-year watch trading and to reward you for reading this, I am giving away my super secret “hack” to WTA members only of how to get buyers/seller off of ebay, just DM me on facebook here: https://www.facebook.com/mohi.ahmed0 and let’s talk about trading!

I can’t thank PJ, Cal, and Allysa enough for WTA, Exotic Car Hacks, and Secret Entourage and the occasional push to invest in my education further that has always provided a huge ROI even if I was a little stubborn at first about pulling the trigger. Because of these courses, my life is on an entirely different and accelerated path than I thought possible. I’d also like to thank some stand out members that have helped me along the way and have now become great friends: Faizan, Sunny, Parker, Camden, Dan, Sam, and Vincent and anyone else I apologize for missing, but you should know who you are! I look forward to everyone’s mutual success and making more friends in this community going forward. See you at the next meet up!